🏡🇩🇰 Get Your Dream Home at the Right Price

Learn the insider tips and strategies to navigate the Danish real estate market with confidence. Negotiate the best possible deal at the best possible price.

From understanding Danish customs to leveraging your own strengths, I’ll guide you every step of the way towards your dream home

🏦 The Biggest Purchase of Your Life: You Must Do It Right

Buying a house or an apartment will be the biggest purchase of your life.

You’re going to be putting down years of savings and committing millions (literally!) in a long-term mortgage.

The stakes are high. You must do this right.

Your home is and will be, after all, the place where you will:

- Grow your family

- Commute to and from

- Live your life

… and all while staying – likely forever – as your highest monthly expense.

There is no bigger and more consequential personal and financial decision than choosing where you live. It is crucial that you get the best deal you can.

That’s exactly what I’m teaching you in this course.

Join me today, and you will – with all certainty – know that you’ve done all you could to get the best deal for yourself and your family.

… and, remember: once you did make the purchase, it’s done. You just can’t “undo”.

You’ll really regret if you knew you could’ve done better. (And without that much extra effort).

💥 Making It Happen to YOU

Are you tired of endlessly searching for your dream home, only to be disappointed by high prices and Denmark’s confusing regulations?

Do you wonder why some people seem to effortlessly find and purchase their dream homes, while you continue to struggle?

The Dream Home Denmark course will give you proven strategies and all my insider knowledge to help you find and buy your dream home at the right price.

Whether you’re an expat navigating the Danish real estate market for the first time, or a seasoned investor looking for your next property, we’ve got you covered:

- This will be specific — I include the exact concepts, systems and models you can use right now.

- This will be fast — it is 3+ hours of new material that you can apply immediately. You can take it at your own pace and revisit it whenever you want.

- This will be incredibly practical — if you’ve already tried a laundry list of random hacks and “trying harder” and you want to go straight to the point to what truly works, this course will give you the exact actionable steps you need to take.

🐚 Have you ever wondered…

- What are the most common mistakes expats make when buying property in Denmark, and how can you avoid them?

- What are the two ways most people in Denmark lose money with when buying a home?

- How can you find hidden gems in the Danish real estate market that others overlook?

I wondered too, and went through countless hours of research to discover all the hidden ins-and-outs of investing in real estate in Denmark.

I took all this and condensed it and optimized it into a system that gets all of these pieces working together, seamlessly.

THIS is what this program is about. It’s the culmination of this enormous research into one, proven, step-by-step system you can use immediately.

The best thing is that you don’t need to have a highly-paid job, a fancy degree or a two-income household to get down through this path.

You just need to take action.

🚨 The High Risks of Making the Wrong Type of Deal

There’s too much money in the line. You’ll (probably) never going to spend as much.

It’s irresponsible to “take it easy” — instead, you need to be as prepared and ready as possible:

- You don’t want to buy something beyond your means –– and have to cut off your holidays, eating out, tech purchases, etc. as 80% of your salary goes to pay for the apartment.

- You don’t want to pay more than the place is worth it — and leave thousands on the table.

- You don’t want to be taken advantage by banks — and be stuck paying high interest rates, when you absolutely don’t need to.

- You won’t want to be abused by “advisors” — and end up stuck paying 50K+ for someone who in theory was “in your team”.

If you’ve gone through my guide — and the extra emails, too — you should’ve seen how obsessed I am with the details. (You should be too!)

👇 I’m Not Your Typical House Buyer

I had been in Denmark for seven years before I bought my first apartment.

🤓 I DIDN’T Want to Buy a House

Seven years may sound excessive, but I had my reasons:

- I didn’t want to get into debt. I never had any debt – of any type – and neither had my wife. I like to be “in control”, and not to worry about money. I like the freedom of not having to owe anything to anyone. Mortgages are debt after all, so it was a hard psychological pill for me to shallow to get one.

- I had a good rental. Yep, believe it or not – I was paying 10-12K all inclusive for a small but nice flat in Frederiksberg, a serviced apartment close to everything. We didn’t have kids and we didn’t need more space. We were good with the small place.

- I wasn’t sure I was going to stay in Denmark. I bought in 2017, and that year alone I spent three months in Panama. It was not a given I would keep living in Copenhagen.

☀️ But Then, I DEEP DIVED

In 2016 and 2017, I started to see a lot of my friends buying a place. I thought: okay, maybe that’s something I could investigate a bit more.

“Bit more” went on to be HUNDREDS of hours learning and researching about buying an apartment in Denmark.

I’m obsessed with the details, and there were a ton to look into: laws and lawyers, financing and interest rates, taxes and fees, a crazy-fast real estate market.

I spent MONTHS looking through all that. I met lawyers, realtors, all major banks, and a multitude of advisors. I visited dozens of houses and apartments.

🤝 Putting My Maersk Skills Into Practice

It helped that I have a unique background: in my job in Maersk (Denmark’s biggest company) I buy things professionally. BIG THINGS: think of think of ports, ships, fleets of trucks, etc.

The Excel models I made and the strategies I put together have been literally used to close contracts worth 1+ billion dollars. You can’t do higher stakes.

I went on to apply all that skillset for my own house purchase:

I then swiped the floor in the house negotiations. I know it for a fact (because the sellers and agents told me!) that they never saw someone as bold and prepared: I squeezed them out of every last kroner possible. I know I couldn’t have done better.

I made the most detailed and bullet-proof Excel models on buying a house you’ll ever see, including every little rule. The banks were wow-ed.

I had all banks lined up to give me the mortgages I wanted and every little perk imaginable. I got so much for free that the bank advisors had to get senior management approvals.

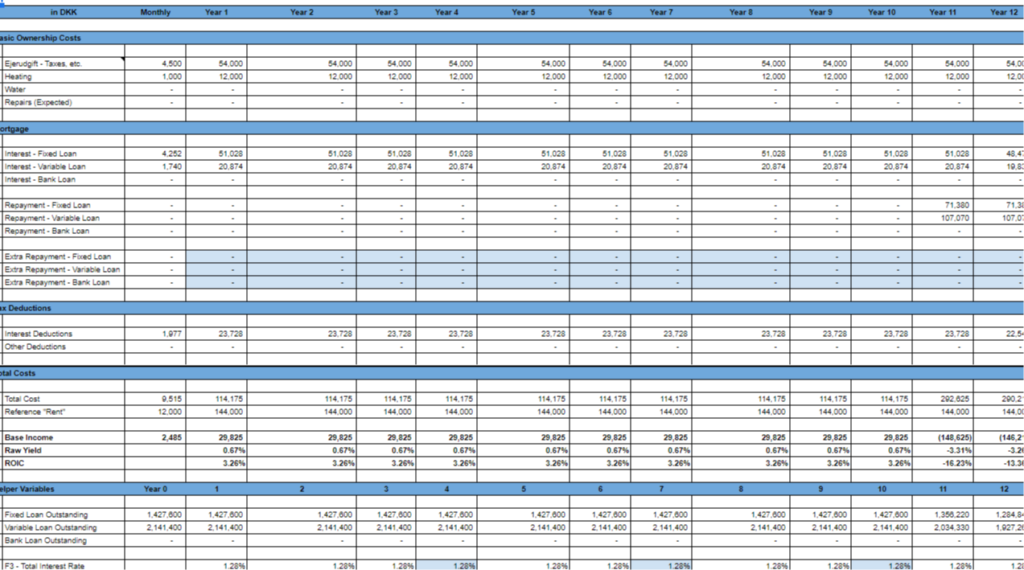

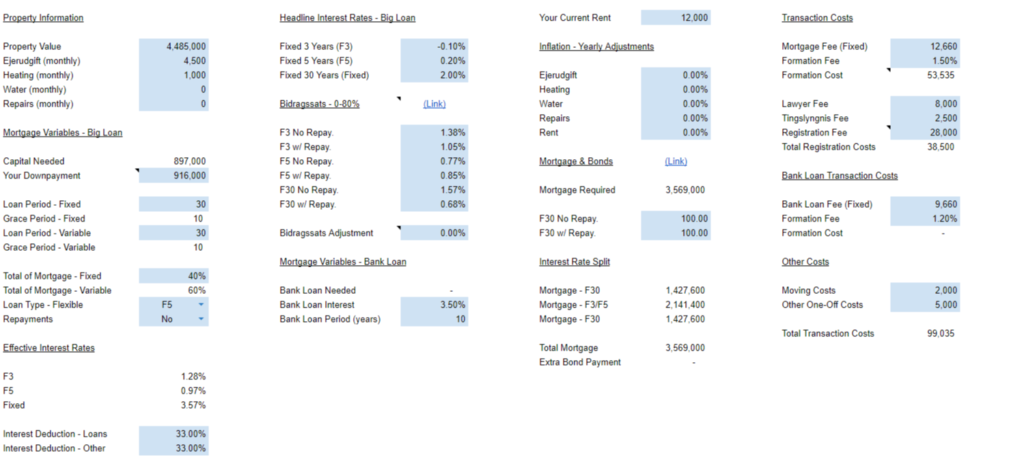

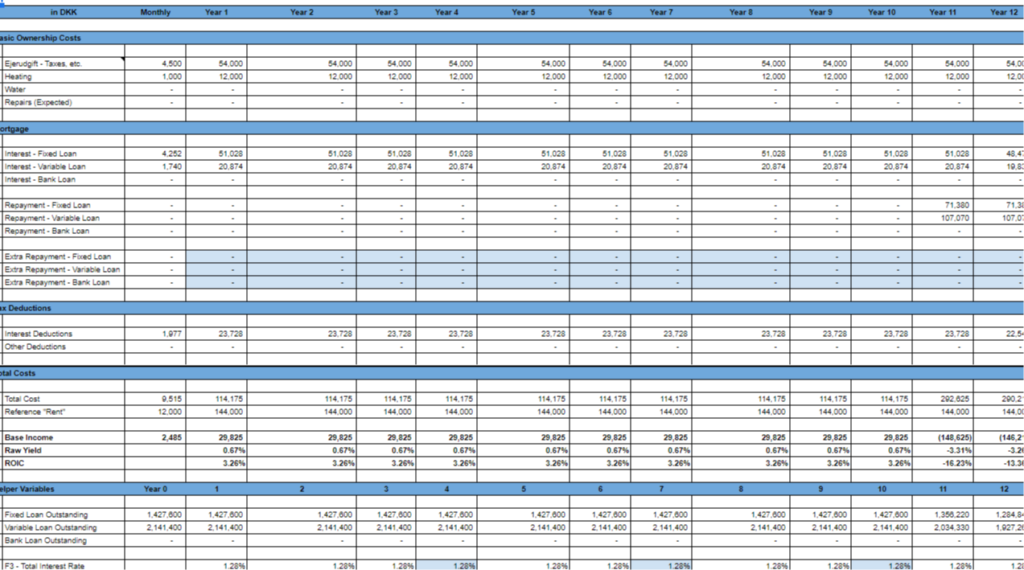

Included: Get Access to My Ultra-Precise Cost Sheets

👉 Learn EXACTLY How Much Your New House Will Cost

To be sure you’re doing the right move, you absolutely need to use an ultra-specific cost model.

The course includes my battle-tested and ultra popular mode, which will help you:

- Negotiate a Better Deal — With Seller & Bank. I bought my place for way less than it was advertised, and got a good deal from my bank. All during a super hot market. You can save as much or more.

- Know How Much You’ll Pay Monthly and Yearly. This, to the specifics — so you know what kind of deal to get, so you can keep traveling, buying what you want, and going out and still having cash in hand.

- Make The Right Loan Decisions. This, so you’re not taken advantage of by the banks — and pay only what is right.

30-Year Projection 🗺️

- Learn Exactly How Much You’ll Pay — This, every year, for 30 years! (This, all ultra-customizable).

- “Any Repayment Setup” — See how much you’ll pay e.g. per month, per year, and in case you take a loan with repayments, no repayments, etc.

30+ Variables 📊

The total cost will dynamically change per your input on any of the following variables: purchase price, downpayment, ejerudgift, heating, water, repairs, loan period, type of loans, loan split, realkredit interest, bank loan interest, loan repayments (or not), moving costs, etc….

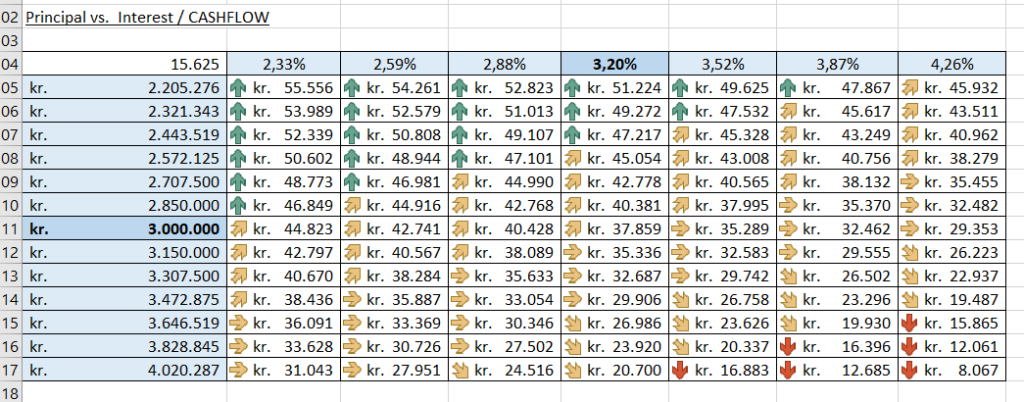

New: Including Sensitivity Tables 🔎

You can run simulations on how much your costs will be in different scenarios depending on agreed purchase price, ejerudgift and interest rates.

Bonus! Get the Negotiation Deck Too 💰

You’ll also get a negotiation-specific tool you can use to prepare, track and follow up with multi-level negotiations.

Included: Get Free Access to My Full Bank Negotiation Course

🏦🇩🇰 Bonus: The Ultimate Bank Negotiation Guide

30+ Lessons, Sections & Toolkits. Normally selling separately for 599 kr. Included for free today.

🏦 Save up to 100K kr. by learning the exact and step-by-step approach to get banks to “treat you as a Dane” (and not an expat!) and appprove you for the best and cheapest loans.

📚 30+ Lessons, Templates, Worksheets and Scripts specific to negotiating with the bank, including:

📝 Bank Checklist — Know every single document you must (or could) present to improve your prospects

📊 Personal Budget Template — The exact template dozens of people (incl. myself!) have used to get approval

🔎 Loan Renegotiation Sheets – So you know exactly how much you save moving from F30 to F5 or getting new loans

🥷 The easy but crucial technique I use in all my negotiations, applied to banks — including a template to implement

✅ 30-Day Money Back Guarantee.This is a one-time purchase. No subscription.

Who’s This For? 👇

🍵 People Serious About Buying a House

✅ You are serious and at least considering buying a house or apartment

✅ You want to get the best deal possible for downpayment, mortgage, interest rate, fees, etc.

✅ You want to save time and money by following a proven step-by-step system

✅ You’ve your “act together” and just need a guiding hand to help you prepare in a structured and straight-forward way

👉 You’re aware you’re about to spend millions (literally!) and want to go the extra mile to make sure that you couldn’t have done better.

💀 Who’s the Course NOT for?

❌ You’re looking for a magic bullet that will cause your life to dramatically improve without any effort. There’s no secret here. It’s just about putting in the work and stacking the deck in your favor in whatever way you can.

❌ You’re afraid of talking with real estate agents – because hey, you’ll have to talk with a lot of them (or not get the best deal)

❌ You’ve no savings and no job and high expectations. If that’s your case, wait until you’re in a stronger position. I won’t be able to help you until then.

🚀 Get My Personalized Feedback on the Houses You’re Interested In

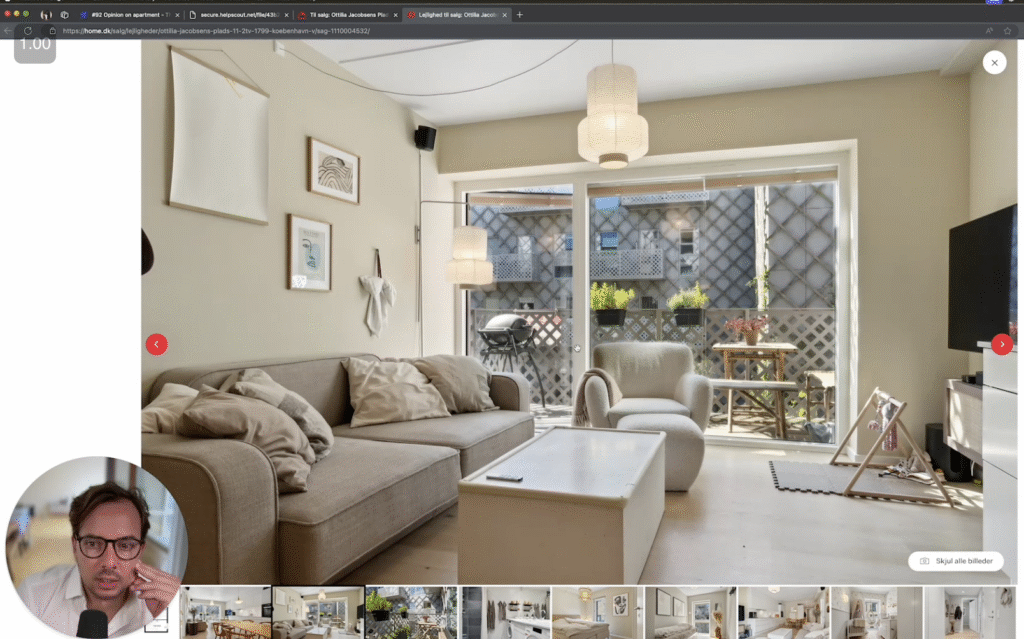

If you’re interested in buying a property and want to know my own opinion on whether it’s a good place, a good deal, this is your opportunity. I can give you my fresh, unbiased and straight-forward opinion.

I’m NOT a Buyer’s Agent, I’m NOT a Real Estate Lawyer, but I do have a lot of experience in the market after talking with 1.000+ people over the past years.

You’ll get a video with screen-share, drawings (if need be!) and my concrete notes on multiple points, including but not limited to:

- Property condition

- Property price

- Right mortgage for the property

- Location

- Overview of expenses

- Risk mapping

- Floor plan optimization

I have a set checklist I have used for this for years and I’ll be going through it for your property.

🔥 30+ Lessons, Sections & Toolkits

🏡🇩🇰 Dream Home Denmark

699 kr. or 3 Payments of 266 kr.

Easily cancel anytime. Risk-free 30-day 100% money-back guarantee.

✅ The most complete super guide to buying a house in Denmark in English.

✅ The Cost Models & Negotiation Dashboards

✅ Case Studies for Houses, Apartments, Townhouses (Rækkehus) and Summer Houses (Fritidsbolig)

✅ How to Negotiate Prices 10%+ Down – incl. my two specific negotiations

✅ Get My Personalized Feedback – I’ll record a 5-10 min video analyzing up to two houses you choose

✅ All Danish Rules & Regulations You’ll Ever Need to Know

✅ Content Vetted by a Real Estate Lawyer

✅ Access to My Private Online Community

✅ 30-Day Money Back Guarantee.

🌟 100% Satisfaction Guarantee – No Risk, Money-Back Promise

I want the investment in this course to be an absolute no-brainer for you. So, if you go through all modules, complete all the exercises, and still don’t find the course useful, drop me an email within 30 days of buying the course and I’ll happily refund your full payment.

🔐 Lock In The Cheap Price

I update the course regularly, and with each update add new sections, videos, spreadsheets, Q&As and a lot more.

The updates are free for anyone who bought the course.

But each time I update the course, the price for new buyers goes up.

💕 What Happy Customers Have to Say

Buyers say very nice things about the course. Here’s what quite a lot of them had to say.

🍀 2025: Massive Course Update

I’ve just bought a new place (my second): a 12m kr townhouse (rækkehus). I learned a ton more and added more than an hour worth of new content, including:

📕 My Negotiation Experience in 2025 – I’ll give you my updated take and strategy on how I got the best deal and the best price even in 2025’s hot real estate market – including on my near-miss on getting a very bad deal.

🤫 “Offline” Deals – I added new videos explaining the ways you find about properties on sale before they’re officially added to Boliga or Boligsiden — and how to make sure you’re not “played” by the real estate agents.

☀Summer Houses (Fritidsboliger) – I added both an explainer on summer houses (what they’re specifically, what rules you should be aware of) and a case study as well, giving my in depth opinion.

📚 What Is Included in the Course

The course is divided into six modules with 30+ video lessons (all with transcripts!), including:

💥 Module 1 – Intro

- Overall map of how to approach this in the most effective way

- Recap of all the must-knows of the Danish market and what makes it special

- Overview of ejer vs. andel and fritidsbolig (summer houses)

- My own story and house buying experience (in depth)

📄 Module 2 – Mortgages in Denmark

- Detailed but easy-to-understand deep-dive on how the mortgage system in Denmark really works

- Explanation on why interest rates in Denmark are so low – (and how that connects to foreigners having a harder time getting a “riskier” loan)

- What is “kurs” – and why it’s important for deciding which mortgage type it’s best for you

- What are the financial market indicators you need to look out for when you setup a new mortgage

- How to save money in administration fees and taxes by taking over someone’s existing mortgage

📊 Module 3 – Cost Modeling

- Immediate access to my ultra-popular cost model so you know exactly how much your dream home will cost

- Easy to use model with step-by-step spoken instructions

- 30+ variables to include even the most complicated scenarios (if that’s what you want!)

🤑 Module 4 – Negotiation

- Everything you’ll ever need to know about negotiation and the scripts and approach to use to get the best possible price.

- My own negotiation stories (in detail, with all the numbers!) and how you can use the same approach — for both times I bought something!

- My “Negotiation Deck” – You’ll also get a negotiation-specific tool you can use to prepare, track and follow up with multi-level negotiations.

- Market Intelligence – The key websites with all the info you’ll ever need to find about any property

- How to learn about the best properties before they come on sale

- My take on Buyer’s Agencies and the alternatives.

🔎 Module 5 – Real Life Case Studies

- How to read the “Salgsopstilling” like a total pro and discover the ins/outs of any property in 2 minutes.

- See me going through and rating and giving feedback on houses, rækkehuser (terraced house/townhouses), apartments and summer houses.

- Everything you’ll ever need to know about project apartments

- You can ask me for feedback on the house you’re interested yourself, and see what other people shared

🗺 Module 6 – Conclusion and Q&A

- Q&As with buyers of the course

- Links to a list of curated resources

🏦 Free Bonus – Get Bank Approval To Buy Your Dream Home

I’m including my huge “Bank Negotiation Guide” course for FREE as part of this purchase. It’s one more full course!

It includes ALL this:

💥 Module 1 – Intro

- Overall map of how to approach this in the most effective way

- Document: List of all banks

- Template: Ultimate Bank Offer Tracking & Negotiation Sheet

- Remember – 80% of the value of a negotiation can be unlocked before even sitting down!

📑 Module 2 – Setting Up for Success

- 6 ways to show “Connection to Denmark” (which is exactly what banks want you to do).

- Getting approval before you start bidding

- Document: Bank Checklist — Know every single document you must (or could) present to improve your prospects

- Template: Personal Budget Template — The exact template dozens of people (incl. myself!) have used to get approval

- + What if you just move to Denmark?

- + What if you need your parents to send you money from abroad

🏦 Module 3 – Meeting the Bank

- How to negotiate a purchase price of even over 5x your yearly income

- How to approval for downpayment as low as 5%

- Overview of F1, F3, F5 and F30 loans, repayments (or not) and how to prioritize

- How to get low-interest bank loans and bank premium status

- How to get the best loan setup for buying an andel

🥷 Module 4 – Negotiation Master Class

- My Top 10 Negotiation Tips – after almost 1 billion dollars of negotiations

- The easy but crucial technique I use in all my negotiations, applied to banks — including a template to implement it

- How to save money on transaction costs – i.e. which costs you can negotiate and which you can’t

- How to continue even if all banks reject you

🗺 Module 5 – Conclusion and Q&A

- Regular live Q&As with buyers of the course

- Links to a list of curated resources

Included: Get Access to My Detailed Guide on Projects

🏗️ Bonus: Deep Dive on Buying Project Apartments

Hands-down the most detailed guide on buying project apartments (or houses) in Denmark you’ll find on the internet.

🕶️ What’s Included

- Detailed but easy-to-understand deep-dive on how to buy a project apartment

- Explanation on why you can to put down zero (or very little) cash when buying a project

- What is the “bank guarantee” – and how to get away with paying as little as possible for it

- Why banks and constructors prefer to work with Danes than with foreigners – and what you can do to get the same benefits

- What to do if your project constructor goes bankrupt or the project gets cancelled after you already paid

Plus…

- How to search and find only project apartments

- How to ensure that the new house has zero defects – and what to do in case there are any issues

- The little-know “loophole” constructors have used to exaggerate the size of the future apartments – and what you can do to challenge them 🤫

🤝 Someone You Can Trust

When I was just starting to learn about money and finance, I wished for someone to just take my hand and guide me through it all.

Someone who’d show me where the real wins were and keep me from making big (and costly!) mistakes.

Someone who cared about helping me live a truly wealthy life, not just someone who’d talk about cutting coupons or obsess over numbers.

And most importantly, someone who’s got the thumbs up from the people I trust.

🎥 10.000+ Social Followers

I’ve popular, free content across the web – from blog, to YouTube, to Instagram and beyond.

🇩🇰 Denmark Angle

I’ve been in Denmark for 10+ years and know the system’s nuts-and-bots to the very details.

🏝️ Walk the Talk

I’ve my fancy corporate job, side business, two kids, work out every day and have traveled to 140+ countries.

💬 Frequently Asked Questions

🇩🇰 What if I JUST moved to Denmark?

You can buy a house and get approved even if you moved to Denmark 3 months ago. Many have. But you need a sensible and proven approach.

I have a special lesson in the Bank Negotiation Module 2 add-on specific on this.

😢 All banks have rejected me, can I still take this course?

Yes! But,if you don’t have savings and don’t have a job (or literally just started working one month ago) I won’t be able to help you get your mortgage NOW. The course can help you prepare for when you’re ready though!

🏦 Do I need a bank pre-approval to make the course worth it?

Absolutely not. The course is great both as a starting point (before you talk with any bank, or visit any house), and also at the very end: when you need the pro negotiation tips.

🎥 How do you give me feedback on the house I’m interested?

I’ll record a video including screen-sharing. The video will be 5 to 10 minute long, and I can analyze up to two properties.

But note that this is a one-off: the intention is NOT to have an email back-and-forth on feedback.

I won’t be your buyer’s consultant.

👾 How will I get support?

If you have any technical problems with the course or a lesson needs to be clarified you’ll be able to reach out to me directly. But keep in mind this doesn’t include 1-1 personalized consulting.

🖥 How long will I get access to the course?

For life! You get access to the course and all future updates for a one-time price. This is not a subscription.

📊 I just want the Excel sheet, or the mortgage report. Do you sell them stand-alone?

I used to sell five different downloads and courses on a variety of topics. Not anymore. I have consolidated all these download into this course only and added a ton of more to boot.

💫 Does the course get regularly updated?

Yes! The course is updated frequently with the latest developments in the market, new tools and feedback I receive.

For Example – In 2025 I just bought my second property and made a big update.

The updates are always free.

💻 What technical equipment do I need to access this course?

It’s better if you’ve a laptop (or desktop) computer, but the lessons and course are also optimized from your phone if that’s what you prefer.

⏳ Will the course help me AFTER I have already bought a house too?

Yes! If you think you didn’t get the best deal, re-negotiate it!

In the course I include the Loan Renegotiation Guide, which you can use to renegotiate for a better mortgage and conditions.

Immediate Access & Unlimited Updates ❤️

You will get access to the course immediately after purchase. It includes unlimited updates. This is one-time purchase.